Base Oil Report

The price of Middle East crude oils being supplied to Asia appears too high given an increase in supply from Iran, Iraq and rival Russia and muted demand from refiners. While benchmark Oman futures have declined 5 percent since the start of the year to end at $102.93 a barrel, the price relative to global marker Brent has been rising. Brent is down 4.5 percent so far this year, but both it and Oman have been trading in a fairly narrow range since January. The Brent-Dubai exchange for swaps DUB-EFS-1M fell to $3.75 a barrel, down from the year-high of $4.44 on March 14. While the maintenance of refineries may boost margins by removing some product supply, it should have the opposite impact on crude prices as fewer cargoes are purchased. At the same time, supply appears to be rising, with Iran taking full advantage of the thaw in its relations with Western nations over its disputed nuclear programme to boost its exports. Iran's exports have exceeded the 1 million bpd allowed under Western sanctions for the past four months. Iran's four major Asian buyers China, India, Japan and South Korea - took a combined 1.16 million bpd in February, up from 994,669 bpd in January.

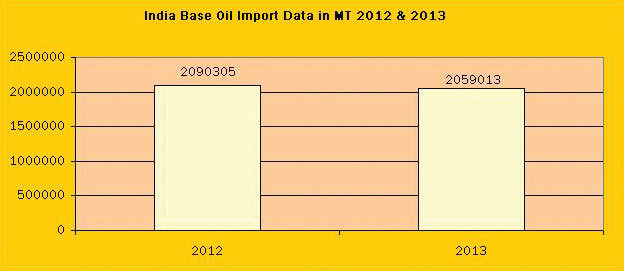

During the period January to December 2013, India imported 2.05 million MT of Base Oil.

Indian State Oil PSU’s IOC/HPCL/ BPCL basic prices for SN – 70/N – 70/N-65/SN – 150/N -150/N – 150 marked down by Rs 0.60 per liter on its basic prices, While SN - 500/N - 500/ MakBase - 500 were marked up by Rs 0.10 per liter. Bright stock prices were up by Rs 0.40 per Liter effective March 01, 2014. Hefty Discounts are offered by refiners which are in the range of Rs. 10.00 – 13.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 60.60 – 60.70/60.90 – 61.30 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current; level is steady. As per conversation with domestic importers and traders prices have inched up for N – 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 60.80 – 61.30/61.75 – 62.45/63.50 - 64.65 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.25 – 0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 61.70 – 62.25 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 66.95 – 68.10 per liter in bulk respectively plus taxes extra.

Approximately 11910 MT of White Oils, Liquid Paraffin’s (Light & Heavy) has been exported during the month of January 2014 from JNPT, Mundra, Ahmedabad, Raxaul LCS, and Chennai port. Compared to December 2013, exports of the country have gone up by 25% in the month of January 2014. It has been exported to 38 countries all over the world. Approximately 3776 MT of Transformer Oil has also been exported during the month of January 2014 from JNPT and Ludhiana port. It has been exported to Algeria, Bangladesh, Brazil, Egypt, Malaysia, Newzealand, Oman, Paraguay, Indonesia, South Africa, Saudi, Singapore, Syria, Taiwan, Thailand and UAE.

| Month | TOBS - 60 Korean Origin CFR | J-150 Singapore Origin Base Oil CFR | Group I - SN 500 Iran Base Oil CFR | Bright Stock - 150 CFR |

|---|---|---|---|---|

| January 2014 | USD 995 – 1000 PMT | USD 1025 – 1035 PMT | USD 930 – 940 PMT | USD 1095 - 1100 PMT |

| February 2014 | USD 985 – 990 PMT | USD 1010 – 1020 PMT | USD 930 – 935 PMT | USD 1065 - 1070 PMT |

| March 2014 | USD 990 – 995 PMT | USD 1020 – 1030 PMT | USD 945 – 950 PMT | USD 1080 – 1085 PMT |

| Since January 2014, prices dipped down by USD 5 PMT (1%) in March 2014 | Since January 2014, prices has marked down by USD 5 PMT in March 2014 | Since January 2014, prices has gone up by USD 15 PMT (2%) in March 2014 | Since January 2014, prices has decreased by USD 15 PMT (1%) in March 2014 |

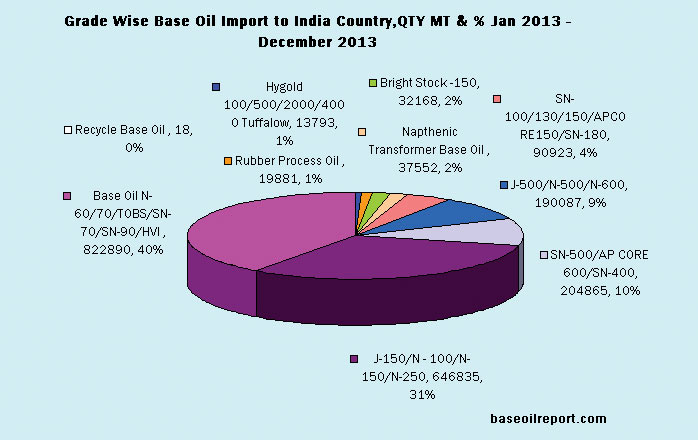

| Grade wise Base Oil import | Qty. in MT | % |

|---|---|---|

| Base Oil N-60/70/TOBS/SN-70/SN-90/HVI | 822890 | 40 |

| J-150/N-100/N-150/N-250 | 646835 | 31 |

| SN-500/AP CORE 600/SN-400 | 204865 | 10 |

| J-500/N-500/N-600 | 190087 | 9 |

| SN-100/130/150/APCORE 150/SN-180 | 90923 | 4 |

| Naphthenic Transformer Base | 37552 | 2 |

| Bright Stock-150 | 32168 | 2 |

| Rubber Process Oil | 19881 | 1 |

| Hygold 100/500/2000/4000 | 13793 | 1 |

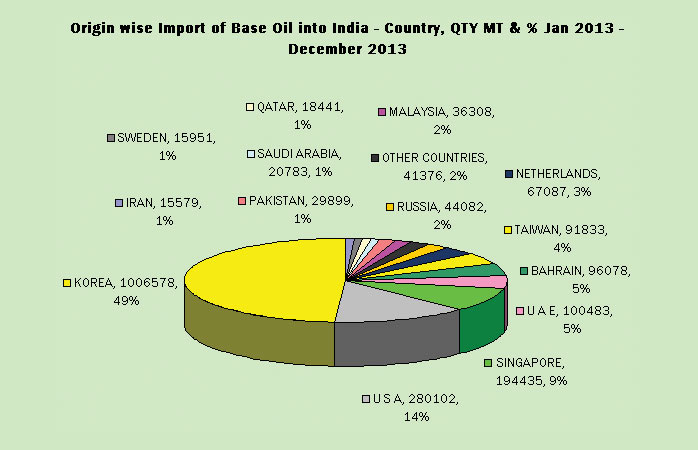

| Base Oil Import Data Country | QTY. in MT | % |

|---|---|---|

| Korea | 1006578 | 49 |

| USA | 280102 | 14 |

| Singapore | 194435 | 9 |

| UAE | 100483 | 5 |

| Bahrain | 96078 | 5 |

| Taiwan | 91833 | 4 |

| Netherlands | 67087 | 3 |

| Russia | 44082 | 2 |

| Other Countries | 41376 | 2 |

| Malaysia | 36308 | 2 |

| Pakistan | 29899 | 1 |

| Saudi Arabia | 20783 | 1 |

| Qatar | 18441 | 1 |

| Sweden | 15951 | 1 |

| Iran | 15579 | 1 |