Base Oil: Building Blocks for Lubricants

Throughout human history, energy has been a key enabler of living standards. This has triggered the evolution of lubrication to give the longer life to machinery & tools. A lubricant can be defined as a substance which can reduce the friction and surface damage resulting upon rubbing of two solid surfaces. Lubrication technology has advanced significantly in recent times, but the roots of lubrication extend back further than imagination. Some of the historical perspectives & milestones are placed here:

From its humble beginnings over 3000 years ago, lubrication technology has seen many phases of evolution. As it continues to evolve at an ever-increasing rate, base oil performance is making a larger contribution to finished lubricant performance. E.g. Turbine oils are the most dramatic example which typically contains over 99% base oil. Base Oils are an integral part of a lubricant providing performance characteristics and benefits.

The Evolution of Base Oil Technology

Early lubrication began with animal fats and oils and slowly evolved to petroleum-based oils over the period.

Base oil is the name given to oils initially produced from refining crude oil or through chemical synthesis. It is the oil with a boiling point that range between 288°C and 566°C. It consists of hydrocarbons with 18-25 carbon atoms. It is classified into various grades including Neutral (N), Solvent Neutral (SN) and Bright Stocks (BS). This oil can be either paraffinic or naphthenic in nature depending on the chemical structure of the molecules.

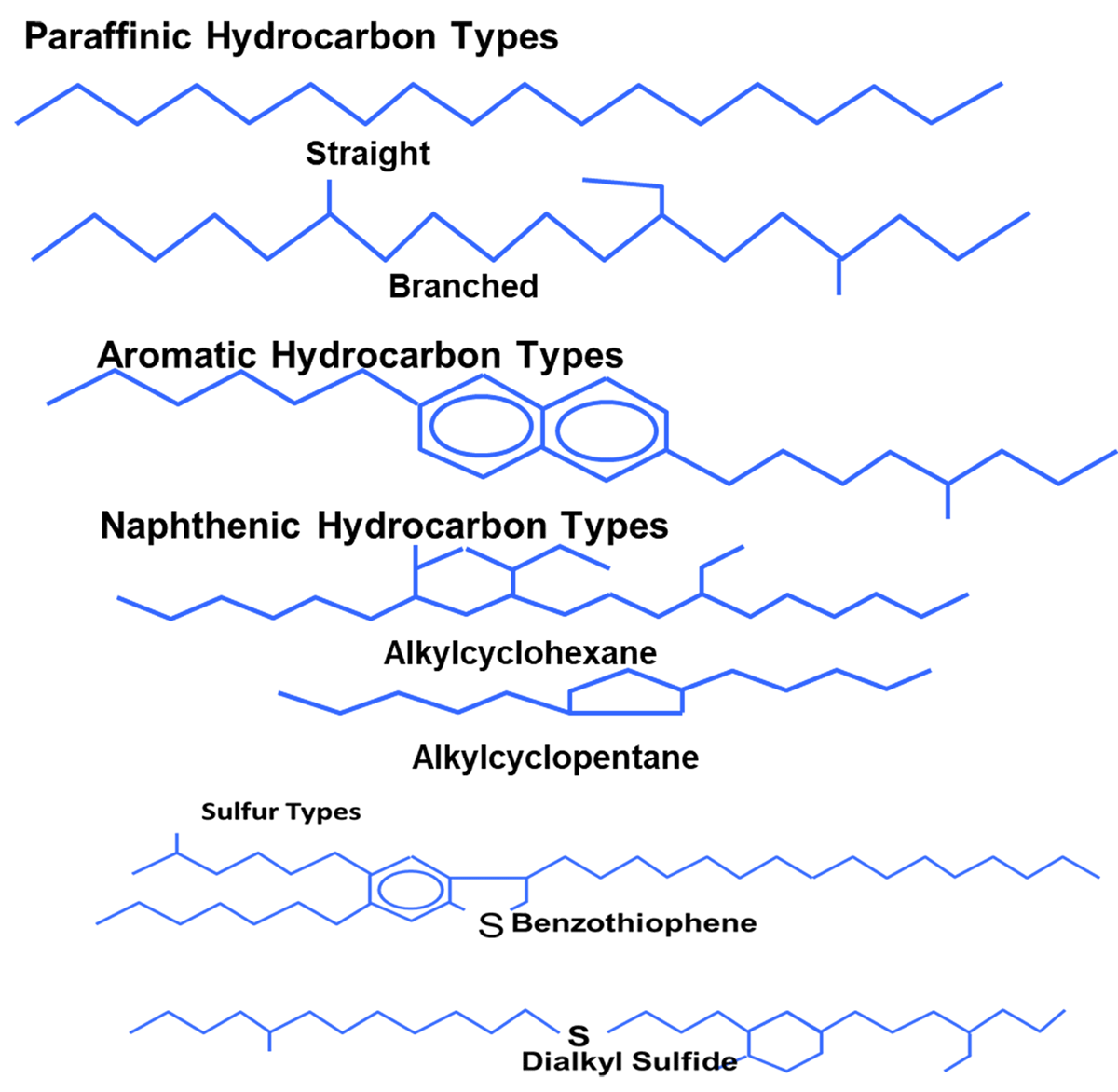

These base oils come from three primary sources: Crude oil; Chemical synthesis and Natural resources other than crude oil (fats, waxes, vegetables, etc.). In order to obtain the different kinds of minerals, a refining process is employed to separate crude oil into the different types through processes of distillation, cracking, hydrogenation, and dewaxing. Crude oil contains three primary hydrocarbon types: Paraffin, Naphthenic and Aromatics. The American Petroleum Institute (API) has introduced a broad classification for all types of base oils as shown in Table 1. Five groups of which indicate performance level of base oils. This grouping also helps to distinguish the broad chemical composition, to minimize lengthy testing for blending and substitution purposes.

| API Group | Saturates | Sulfur | VI Group | Typical Manufacturing Process |

|---|---|---|---|---|

| I | <90% | >0.03% | 80-119 | Solvent Processing |

| II | >90% | <0.03% | 80-119 | Hydro processing |

| III | >90% | <0.03% | ≥ 120 | (Severely Hydro-processed/ Catalytic dewaxing) |

| IV | N.A | N.A | N.A | Poly Alpha Olefns (PAO) |

| V | All other Base Stocks which are not covered in Group I to IV (Polyglycols, Esters, Silicons, etc.) | |||

Refining Processes for Base Oil Production

Based on the API classifications of base oils, refining processes of Group I to III base oils are primarily selected on viscosity index ranges as shown in Table 2.

Base oil composition depends upon the following two factors:

a) Crude Oil Source

Crude oil sourcing depends upon the each oil field because of its unique composition which affects the output of refining process. The crude composition mainly consists of

- Types of Hydrocarbons [Paraffinic/Aromatic/Naphthenic/sulphur type)

- Sulphur

- Nitrogen

The other factor of crude sourcing depends upon availability which is normally influenced by

- Economics

- Abundance Availability

- Logistics

- Current political & market scenario

- b) Refining Process

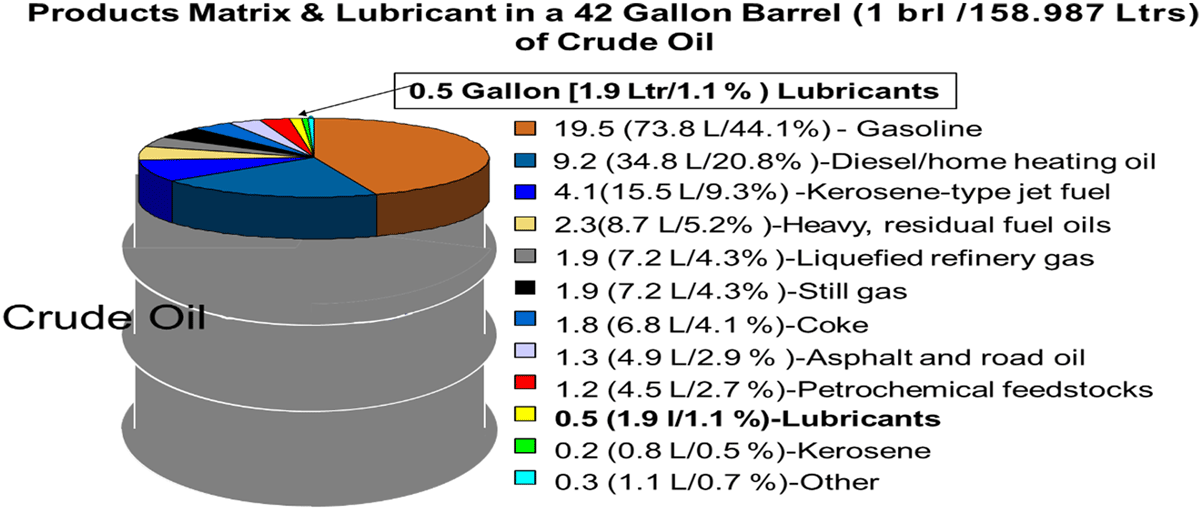

A crude oil itself a source various petroleum products which are extracted/converted by suitable refining /conversion processes.

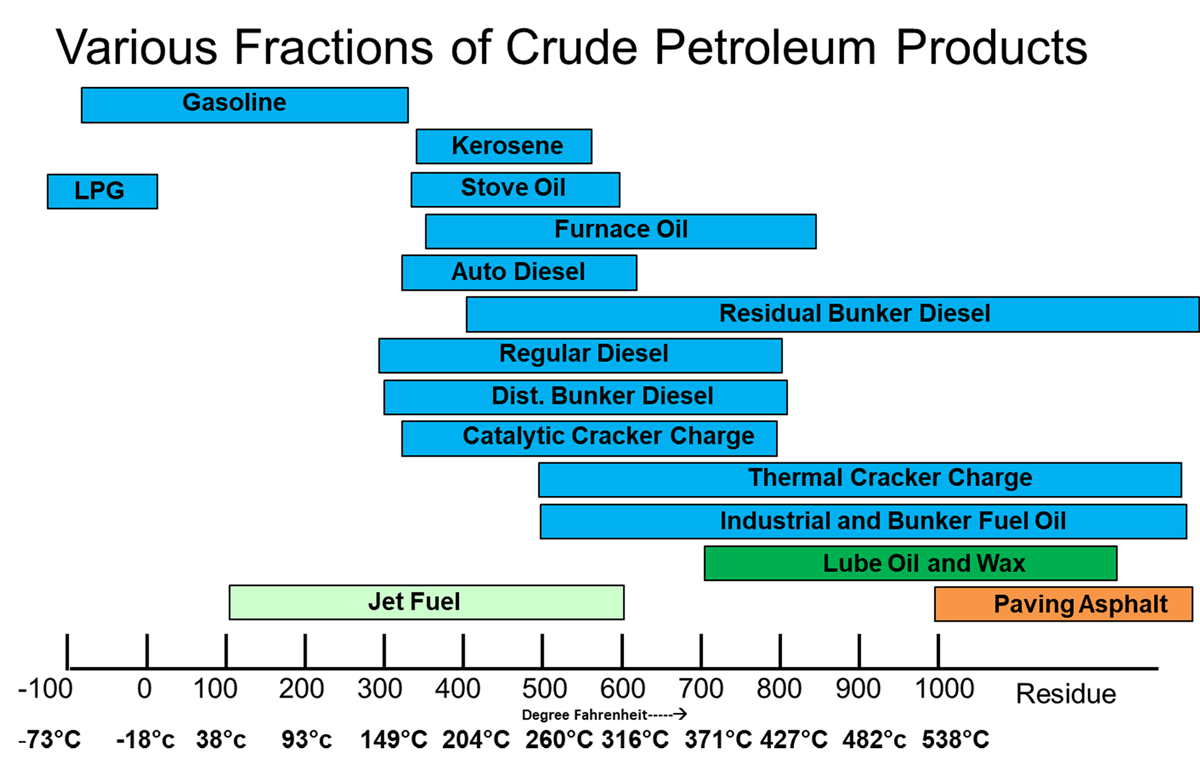

Various fractions of crude oil are given in Fig- 2 & 3:

The manufacture of lube base oils can be done using any of the following processes below, [Wright, (2014)]

- Extraction Process

- Conversion Process

A. Extraction Process

According to Wright (2014), the extraction process is achieved in a sequence of processes namely: Distillation, De- asphalting, Extraction (Dewaxing (Catalytic dewaxing, solvent dewaxing), Finishing ( clay contacting or Hydrogen finishing ).

1. Distillation process

This process separates the atmospheric residue mixture into a series of fractions representing different viscosity, ranges from 90 - 500 neutrals. The neutral number is the Saybolt Universal Seconds (SUS) viscosity at 100℉. The residue contains the heavier base oils such as the bright stocks. (150 - 250 SUS at 210℉). The latter is separated from resins and asphaltenes prior to introduction into the extraction process.

2. De-asphalting

It takes the residuum from the bottom of the distillation column and removes asphaltenes that are dark in colour and form carbonaceous deposits on heating. The process separates bottom residue into two products i.e. de-asphalted oil (DAO) and tar. De-asphalted oil is similar to the lube distillates but possesses higher boiling points and used for bright stock production.

3. Extraction Process

This process involves the removal of impurities such as aromatics, sulfur and nitrogen compounds. Aromatics make poor quality base oils because they are among the most reactive components in the natural lube oil boiling range. Oxidation of aromatics can start a chain reaction that can dramatically shorten the useful life of base oil. The viscosity of aromatic components in base oil also responds relatively poorly to changes in temperature. Lubricants are often designed to provide a viscosity that is low enough for good cold weather starting and high enough to provide adequate film thickness and lubricity in hot, high-severity service. Therefore, to meet the requirement of hot & cold performance, the small response to changes in temperature with respect to viscosity is desired. The relative property of base stock which indicates the response to cold & hot performance is expressed as VI (Viscosity Index). A higher V.I. indicates a smaller, more favourable response to temperature. Conventionally, solvent extraction was adopted as the purification process, in which aromatics are removed by feeding the raw lube distillate into a solvent extractor where it is counter-currently contacted with a solvent. The popular choices of solvent in the oil industries are furfural, n-methyl pyrrolidone (NMP), and DUO-SOL™. Phenol was another popular solvent but it is rarely used today due to environmental concerns. Solvent extraction typically removes 50-80% of the impurities (aromatics, polars, sulfur and nitrogen containing species). The resulting product of solvent extraction is usually referred to as a raffinate.

4. Dewaxing Process

This process removes wax to improve the pour point and low temperature properties of base oil. To improve the low temperature properties of base oil following dewaxing processes are used:

-

Solvent Dewaxing: It utilizes dewaxing solvents like methyl-ethyl-ketone (MEK), toluene or phenol to be mixed with the waxy oil. The mixture is then cooled to a temperature 10 to 20 degrees below the desired pour point . The wax crystals are then removed from the oil by filtration.

More desirable alternatives to solvent dewaxing are: -

Catalytic Dewaxing: Catalytic dewaxing was a desirable alternative to solvent dewaxing especially for conventional neutral oils, because it removes n-paraffins and waxy side chains from other molecules by catalytically cracking them into smaller molecules. This Process improves the pour point&low temperature properties of the base oil.

-

Wax Hydroisomerization: The more advanced form of the catalytic dewaxing process. This process isomerizes n-paraffin and other molecules with waxy side chains into branched chain molecules with very desirable quality like lowering of pour point & superior lubricating qualities of base oils rather than cracking them away.In 1993, the first modern wax hydroisomerization process was commercialized by Chevron . This was an improvement over earlier catalytic dewaxing.Hydroisomerization also saturates the majority of remaining aromatics and removes the majority of remaining sulfur and nitrogen species. Modern wax hydroisomerization makes products with exceptional purity and stability due to extremely high degree of saturation.They are very distinctive because, unlike other base oils, they typically have no color.

5. Hydrofinishing Process

It is the final process in the manufacturing of base oils. Its aim is to improve color and thermal/oxidative stability of base oil. In this process hydrogen is added to base oil at an elevated temperature in the presence of catalyst. Hydrotreating is a more recent form of purification process. By reaction of hydrogen with some remained sulfur and/or nitrogen containing molecules, these sulfur/nitrogen containing compounds are decomposed into smaller molecules. A great majority of sulfur, nitrogen and aromatics are thus removed. This massive reforming process produces molecules that have improved isometrics, oxidative stability and product colour.

B. Conversion Process

The following, according to Wright (2014), is a simplified description of the conversion processes: Distillation, Hydrocracking, Hydrodewaxing/ Hydroisomerization, Hydrotreating.

-

Distillation process: This process separates the atmospheric residue mixture into a series of fractions with different molecular weight and viscosity ranges.

-

Hydrocracking: Hydrocracking is a more severe form of hydro processing. In hydrocracking, the base oil feedis subjected to a chemical reaction with hydrogen in the presence of a catalyst at high pressures above 1000 psi and temperatures above 650°F/340°C . Feed molecules are reshaped and often cracked into smaller molecules. The naphthenic and aromatic carbon rings are broken, and re-joined using hydrogen to form an iso-paraffin structure. In this process a great majority of the sulfur, nitrogen, and aromatics are removed. Molecular reshaping of the remaining saturated species occurs as naphthenic rings are opened and paraffin isomers are redistributed, driven by thermodynamics with reaction rates facilitated by catalysts. Clean fuels are by-products of this process.

A primitive version of the hydrocracking process was attempted for lube oil manufacturing in the 1930s but was soon abandoned for economic reasons after the solvent refining process was commercialized. Later hydrocracking technology continued to improve over the period.

In 1969 the first hydrocracker for Base Oil Manufacturing was commercialized in Idemitsu Kosan Company’s Chiba Refinery using technology licensed by Gulf [4]. This was followed by Sun Oil Company’s Yabucoa Refinery in Puerto Rico in 1971, also using Gulf technology [2].

-

Hydrodewaxing: In this process a hydrogenation unit is used to deploy a catalyst that is specific to conveying waxy normal paraffin to more desirable isoparaffin structures.

-

Hydrotreating: The process helps to introduce saturation of any unsaturated molecules by adding hydrogen to base oil at elevated temperature( above 600°F/316°C)& pressure (Above 500 psi ) in presence of catalyst. Hydrotreating was developed in the 1950s and first used in base oil manufacturing in the 1960s by Amoco and others. It was used as an additional “cleanup” step added to the end of a conventional solvent refining process. Hydrotreating process helps to stabilize the most reactive components in the base oil, improve color, and increase the useful life of the base oil. This process removed some of the nitrogen and sulfur containing molecules but was not severe enough to remove a significant amount of aromatic molecules. Hydrotreating was a small improvement in base oil technology that would become more important later. Most of the unsaturated hydrocarbon molecules turned to saturated hydro carbon chain after hydrotreatment. These saturated molecules are more stable and will be able to resist the oxidation process better than the unsaturated molecular variety.

Several different reactions occur in this process, the principal ones being:

- Polar compounds containing oxygen, sulphur and nitrogen removal.

- Aromatic hydrocarbons conversion to saturated cyclic hydrocarbons.

- The breaking up of heavy polycyclo-paraffin to lighter saturated hydrocarbons. These reactions take place at very high temperatures (380 - 420°C) and pressures (216–217 Bars) in the presence of a catalyst. The hydrocarbons that are formed in the process are very stable (Wright, 2014).

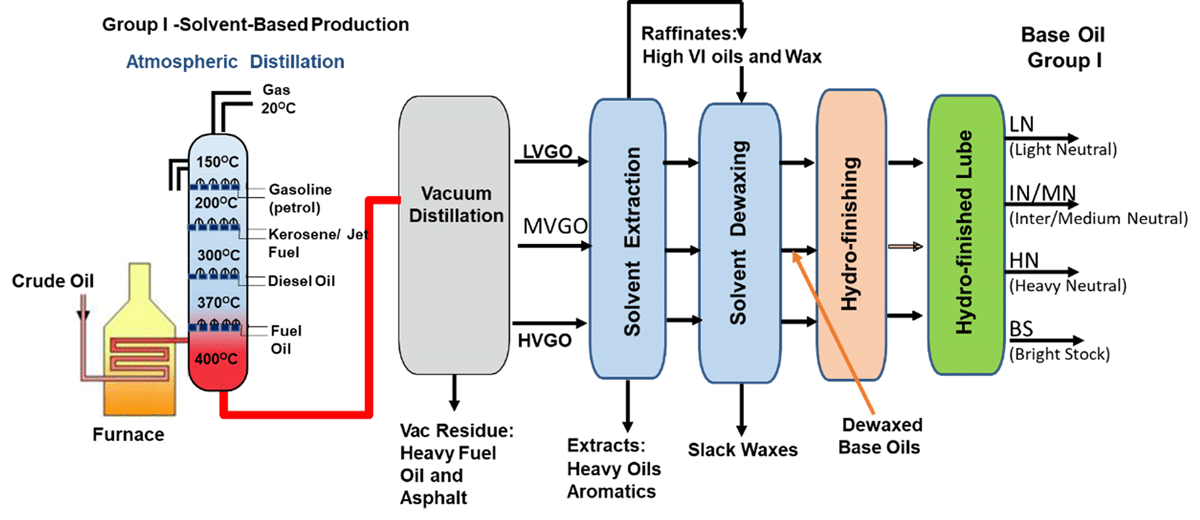

Group I Base Oil Processes

Producing Group I base stocks starts with vacuum gas oil (VGO), one of the heavier streams coming out of the crude unit. Solvents are used to selectively remove 50-80% of the impurities. However, the treated base oils stream still has paraffins that need to be removed to produce usable base stocks. The paraffins are removed by a dewaxing process that uses solvents taken to a low temperature, where the wax is precipitated out.

Following refining processes are used for Group I Base Oil manufacturing [Fig- 4]:

-

Vacuum Distillation: [Removes metals &heavy asphaltic compounds; fractionates into viscosity cuts]

-

Deasphalting (bright stock only): [Removes asphaltenes that are dark in colour and form carbonaceous deposits on heating ]

-

Solvent Extraction: [Removes aromatics, especially the multi-ring aromatics; improves thermal and stability and VI]

-

Solvent Dewaxing: [Removes wax; improves pour point, low temperature properties ]

-

Hydro finishing: [Improves colour and the stability of the base stock]

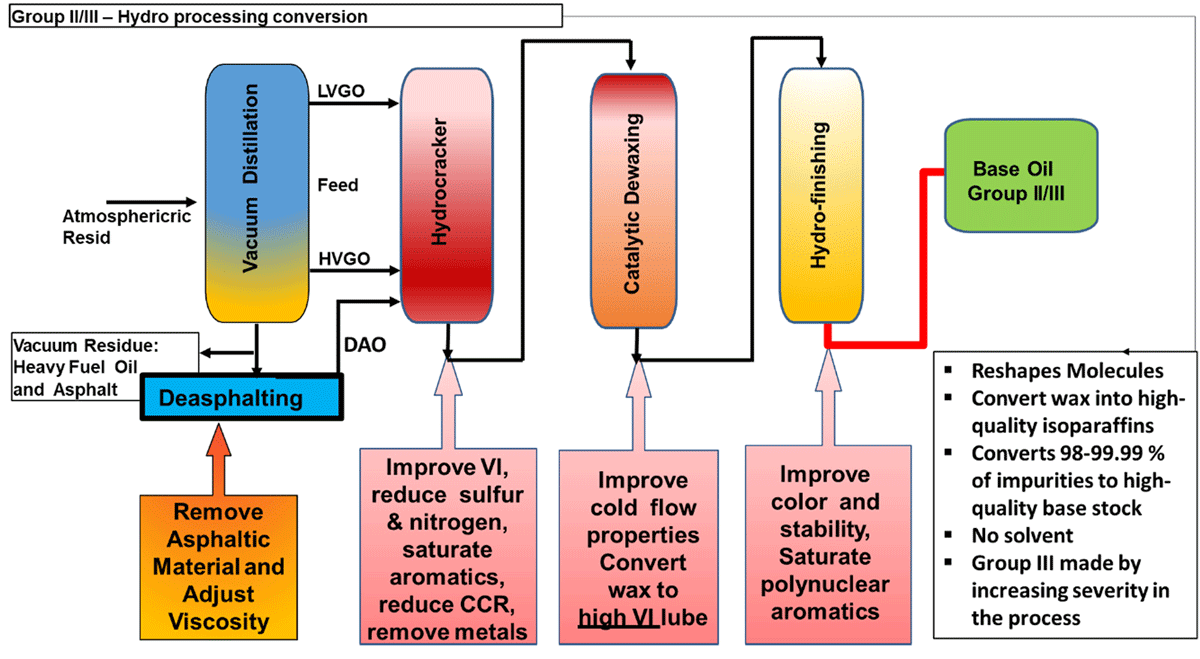

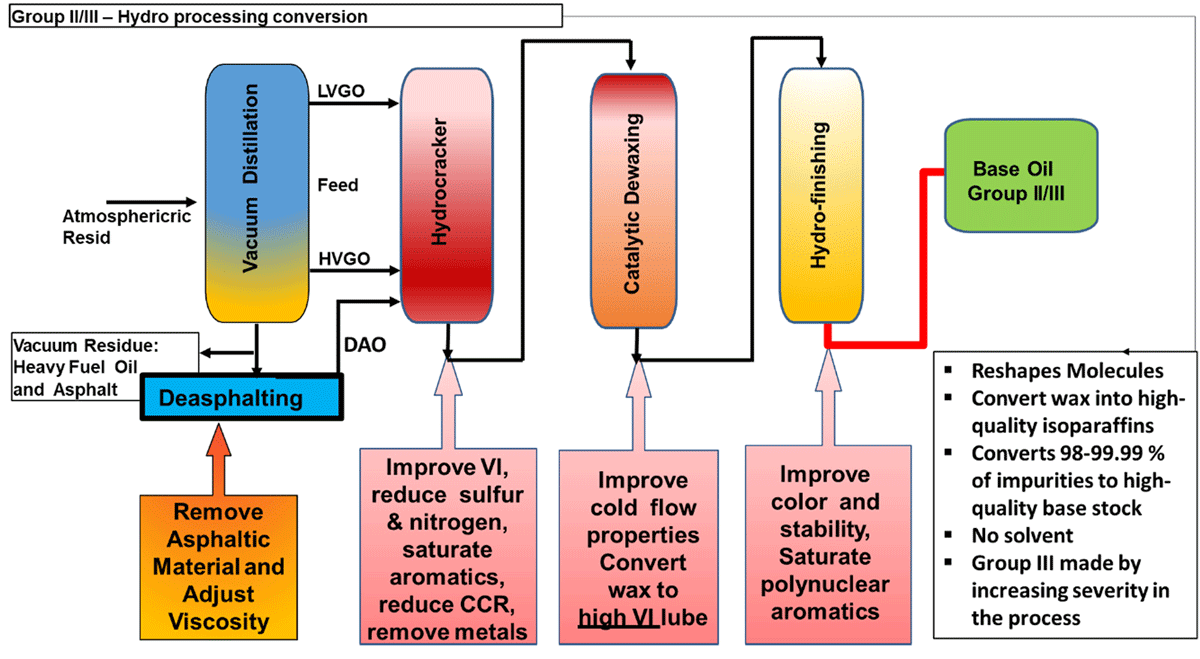

Group II - Modern Conventional Base Oils

All hydroprocessing for base oils starts with the same feed as a solvent plant. However, instead of using a solvent to remove undesirable compounds, the feed is processed in a high-pressure hydro-cracker with catalysts that reshape the molecules, saturate the aromatic compounds and create high quality iso-paraffins. In total, 98-99.9% of the impurities are converted to high quality base oils. Group II base oils are differentiated from Group I base oils because they contain significantly lower levels of impurities (<10% aromatics, <300 ppm S) and almost close to water like colour. Group II oils made using modern hydroisomerization technology are purity means that the base oil and the additives in the finished product can last much longer. More specifically, the oil is more inert and forms less oxidation by products that increase base oil viscosity and react with additives.

Group II is typically produced by processing VGO in a dedicated base oil hydrocracker in a gasoline refinery. Following refining processes involved in Group II/II+

- Hydro-cracking

- Removes O, S and N compounds

- Converts (saturates) aromatics into naphthenes

- Converts ‘cracks’ long chain aromatics and naphthenes to iso- and n- paraffins

- Catalytic Dewaxing

- Converts ‘cracks’ the wax to lighter fuel products - improves pour point, low temperature properties

or

- Hydroisomerisation

- Converts (isomerises) n-paraffins to iso-paraffins; improves pour point, low temperature properties, increases yields

- Hydrofinishing

- Converts trace impurities; Improves color and the stability of the base stock

Group III - Unconventional Base Oils

API defines the difference between Group II and III base oils only in terms of the VI. Base oils with a conventional VI (80 to 119) are Group II and base oils with an unconventional VI (120+) are Group III. Group III oils are also sometimes called unconventional base oils (UCBOs) or very high viscosity index (VHVI) base oils.

Solvent-dewaxed Group III base oils have been in market for last more than 10 years. Over the decades the quality of Group III base oils have been improved significantly as compared to the first generation Group III oils due to upgraded/modern Isodewaxing process.

Group III is primarily produced by processing unconverted oil (fractionator bottoms) from a two-stage diesel hydrocracker. Whilst any diesel hydrocracker can make some Group III feedstocks, they are most efficiently produced in large-scale diesel hydrocrackers. Modern Group III base oils are manufactured by essentially the same processing route as modern Group II base oils. Higher VI is achieved by increasing hydrocracker severity or by changing to a higher VI feed. Fig-5

Modern Group III base oils have properties which allow them to perform at a level that is significantly higher than “conventional” Group I and Group II base oils, and they substantially match existing levels of performance in finished lube applications already established by traditional synthetic oils.

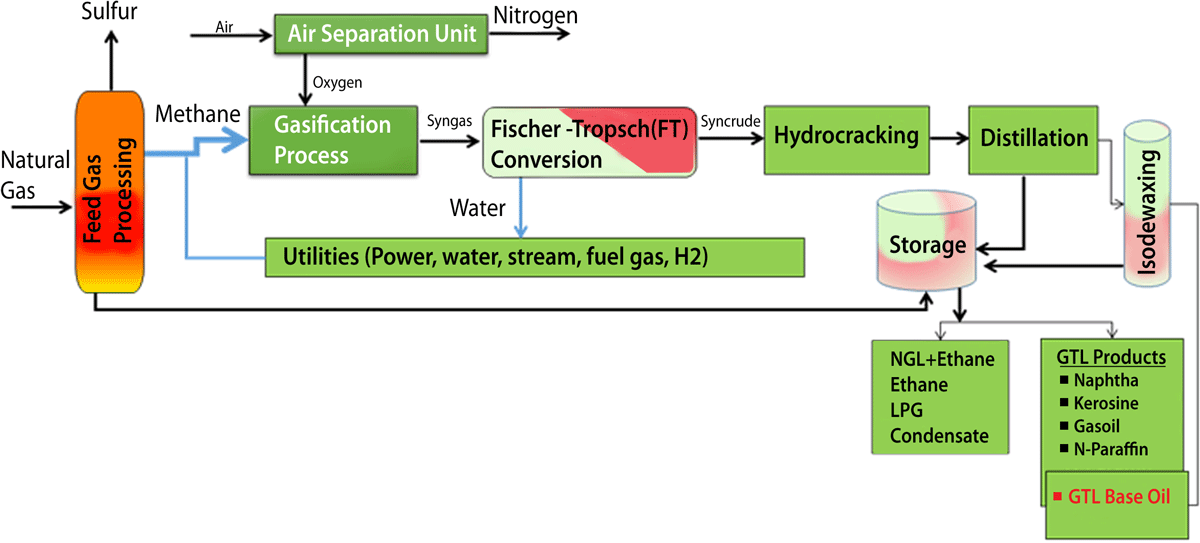

Group III+ GTL Base Stocks

The idea to produce base oil for lubricant applications using natural gas as the hydrocarbon source was developed 40 years ago at the Shell Technology Center in Amsterdam, The Netherlands. Several years later, the conversion reaction was optimized in a laboratory bench-scale reactor. During the 1980s and 1990s, this reaction was scaled up to a pilot plant and then to a small commercial plant. During this development process, several optimizations were made and captured in more than 3,500 patents. This innovation culminated into a commercial reality with the opening of the world-scale Pearl GTL plant in Qatar in 2011. Pearl GTL Qutar produces 140 Mbpd of synthetic GTL products and 120 Mbpd of NGL and ethane.

The first large-scale GTL base oil plant started up in 2011. It uses the same hydro-isomerization process as that used to produce Group II and Group III base oils. Like its Group II and Group III counterparts, GTL base stocks have exceptional thermal and oxidative stability. What distinguishes them from other hydroprocessed base oils are their high VI of 135-145. Consequently, GTL base stocks are classified as Group III+, an unofficial API category that recognizes their higher VI than other Group III base stocks.

The Shell’s GTL technology is Fischer-Tropsch (FT) synthesis, based on the catalytic production of paraffin hydrocarbons from carbon monoxide (CO) and hydrogen (H2).18Natural gas, the cleanest-burning fossil fuel, was chosen as the preferred hydrocarbon source because it is affordable, available and environmentally acceptable.

Fig.8 : GTL Process for Clean Base Oil [Source Shell’s GTL process.]

In addition to the FT reaction, there are several other steps involved in the conversion of natural gas to finished base oils and motor oils, as shown in Fig.8. Shell is the world’s largest producer of GTL base oils at a commercial scale.

Group IV - Traditional “Synthetic” Base Oils (PAO)

The word “synthetic” in the lubricants industry has historically been synonymous with polymerized base oils such as poly-alpha olefins (PAOs), which are made from small molecules. Group IV base oils are chemically engineered synthetic base stocks. Polyalphaolefins (PAO's) are a common example of a synthetic base stock.

Polyalphaolefins (PAO’s) chemical structure and properties are identical to those of mineral oils.Polyalphaolefins (synthetic hydrocarbons) are manufactured by polymerization of hydrocarbon molecules (alphaolefins). The process occurs in reaction of ethylene gas in presence of a metallic catalyst.

These oils are true synthetic lubricants, made through a process called synthesizing. Manufacturing PAO starts with an ethylene cracker making the simplest olefin (ethylene) from hydrocarbon feeds. The primary cracker feed is naphtha. Ethylene is selectively polymerized into linear alphaolefins (LAOs). The heart of the LAO production is C4, C6 (~16%), C8 (12-13%), and drops off to about 10% for C10 and 8% for C12. The lighter alphaolefins, C4-C8 cuts, are co-monomers for plastics, whilst the C12-C16 cuts typically go into detergents and the very heavy ones -- >C24 go into specialty applications.The C8, C10 and C12 LAO can be oligomerised into Polyalphaolefins (PAO). Most C8 goes to co-monomer for plastics, only a little goes to PAO. PAO is primarily made from C10 LAO. Additionally, PAOs require a final hydrotreating step to fully saturate the double bonds.

PAOs have very stable chemical compositions and highly uniform molecular chains. They have a much broader temperature range and are great for use in extreme cold conditions and high heat applications. They also have higher shear strength, and are less prone to oxidation at higher operating temperatures. Although a little more expensive than the crude API base oil groups, synthetic lubricants have extended life and donot degrade as rapidly as regular oils, thereby saving on oil changes downtime. They are also more energy efficient, resulting in further operating cost savings.These base stocks were first time commercially used in lubricant by Mobil in the 1960s.

Given the competition for feedstock and complexity of the PAO production process, PAO supply will continue to be limited and relatively costly.

Group V base oils

Group V base stocks include all other base stocks not included in I, II, III, IV API base oil groups. These include silicone, phosphate ester, polyalkylene glycol (PAG), polyolester, bio-lubes, etc. Sometimes these base oils are mixed with other base stocks to enhance the lubricant’s properties.

Polyglycols are produced by oxidation of ethylene and propylene. The oxides are then polymerized resulting in formation of polyglycol. Polyglycols are water soluble.

Polyglycols are characterized by very low coefficient of friction. They are also able to withstand high pressures without EP (extreme pressure) additives. Ester oils are produced by reaction of acids and alcohols with water. Ester oils are characterized by very good high temperature and low temperature resistance. Silicones are a group of inorganic polymers, molecules of which represent a backbone structure built from repeated chemical units (monomers) containing Si=O moieties. Two organic groups are attached to each Si=O moiety: e.g. methyl+methyl ( (CH3)2 ), methyl+phenyl ( CH3 + C6H5 ), phenyl+phenyl ( (C6H5)2 ). The most popular silicone is polydimethylsiloxane (PDMS). Its monomer is (CH3)2SiO. PDMS is produced from silicon and methylchloride. Other examples of silicones are polymethylphenylsiloxane and polydiphenylsiloxane. Viscosity of silicones depends on the length of the polymer molecules and on the degree of their cross-linking. Short non-cross-linked molecules make fluid silicone. Long cross-linked molecules result in elastomer silicone.

Group V base oils are used primarily in the creation of oil additives. Esters and polyolesters are both common Group V base oils used in the formulation of oil additives. Group V oils are generally not used as base oils themselves, but add beneficial properties to other base oils. Some examples of Group V Base Oils are: Alkylated Naphthalene, Esters, Poly-alkylene glycols, Silcones, Polybutenes.

Esters are Group V base oils commonly used in different lubricant formulations to improve the properties of the other base oil. Ester oils can operate at higher temperatures whilst also providing superior detergency compared to PAO synthetic base oils. This improves their oxidation resistance which in turn increases the oil change intervals.

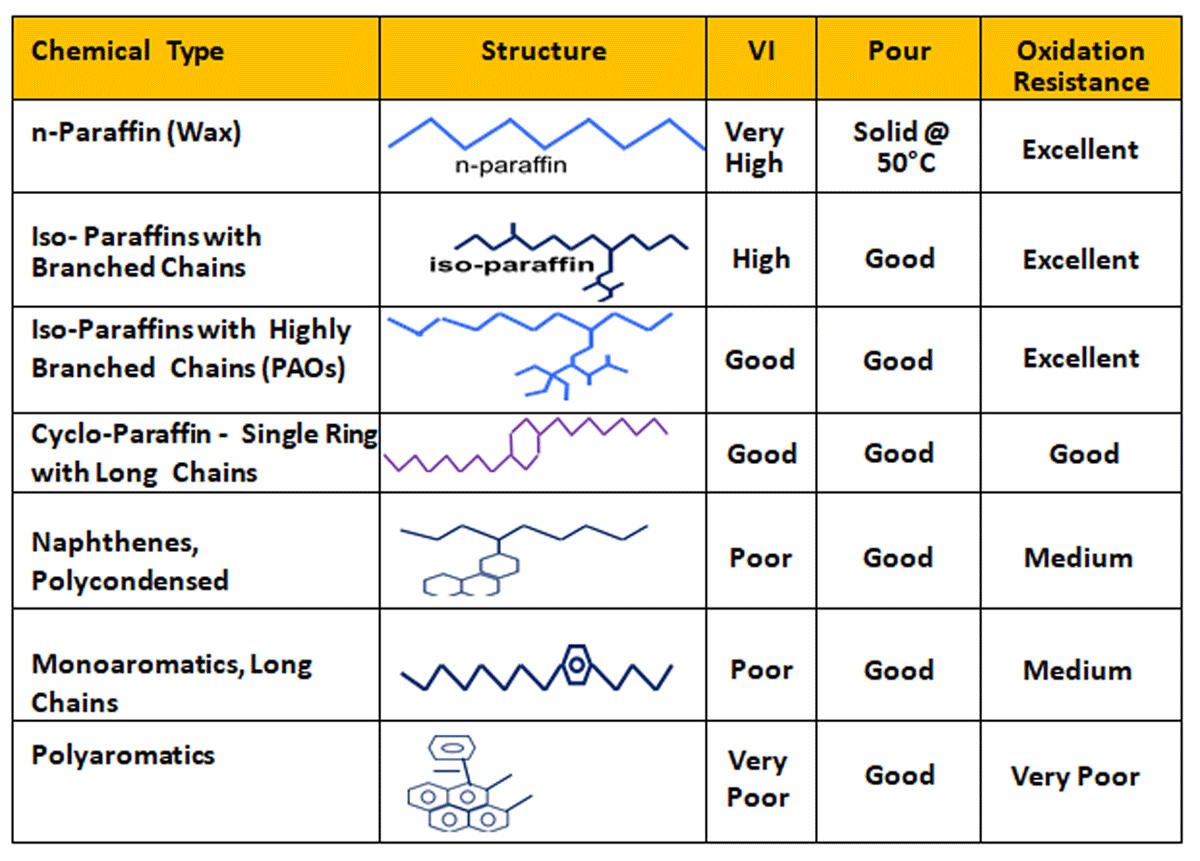

Performance of Base Oils and Future Trends

The growing demand for high-performance lubricants (owing to their better and improved properties, such as reduced flammability, reduced gear wear, and increased service life), is driving the market. High oxidation stability and thermal stability are obtained by using base stocks that contain minimal amounts of unstable aromatics. Base stocks that have these qualities include hydro processed mineral base oils ( Group II,III & III plus ) & synthetics such as polyalphaolefins (PAO) . Hydroprocessed mineral base oils vary from high quality and high VI (95 to 105 VI) to excellent quality unconventional base oils (UCBO) with VI ranging from 115 to 140 and above. The most desirable hydrocarbons in base oils are C20+ iso-paraffins with high VI, low pour point, and excellent resistance to oxidation. Naphthenic compounds in this molecular weight range with long, branched alkyl side chains are also very desirable molecules. For a given viscosity, these highly paraffinic molecules have low volatility relative to aromatics.

Normal paraffins have high VI and high resistance to oxidation. However, they are undesirable as base oil components due to their high pour points. For the same reason, some iso-paraffins, naphthenic and aromatic compounds with long paraffinicchains are also undesirable. Naphthenic aromatics are typically susceptible to oxidation. Polycyclic naphthenic aromatics have low VI and poor stability. Organic molecules, which contain heteroatoms such as nitrogen, oxygen or sulphur, have very low VI and often have poor thermal and oxidative stability. The above desired qualities of improved base oils are achieved by Hydroprocessing, ISOdewaxing & hydro finishing.

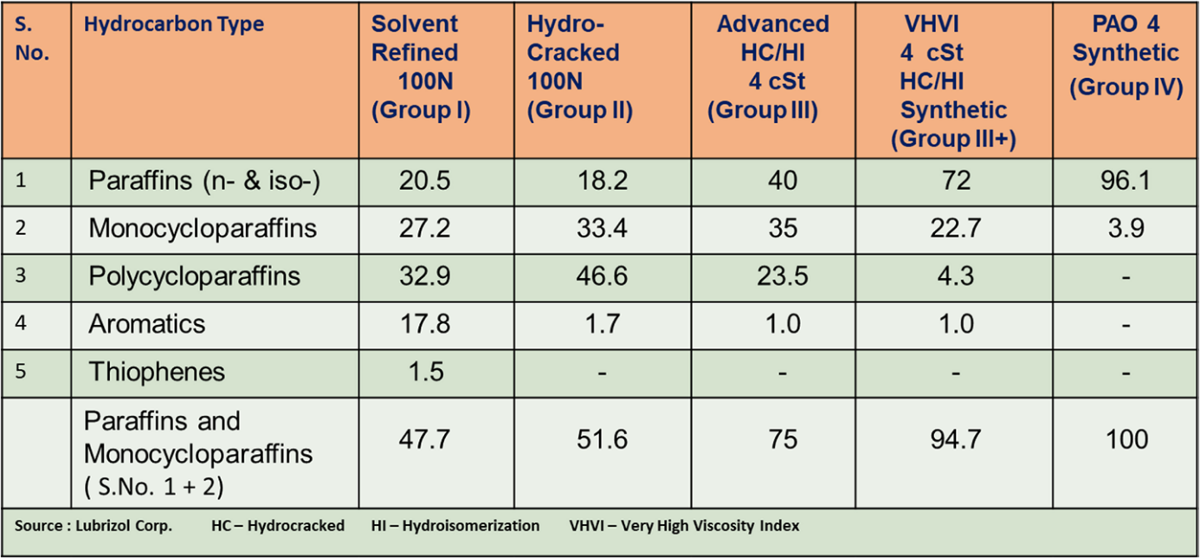

Typical hydrocarbon composition of base oils as given in Table 2 which varies in all categories and differentiate them from each other in terms of performance quality.

Rapid growth in automobile & other industrial sectors due to emerging of new technology, need of higher quality motor& industrial lubricants specifications is driving the demand. New formulations will emphasize the characteristics like lighter viscosity grades for increased fuel economy; low volatility for reduced oil consumption; improved oxidation and thermal stability for longer drain intervals; and improved high-temperature, high-shear (HTHS) viscosity characteristics for application to modern engine designs.

OEMs are recommending the usage of these lubricants for better engine efficiencies and presence of large number of luxury vehicles in the market deriving the demand for high performance lubricants.

The chemical composition of base oils and their respective quality features are broadly given in Table 3 which is finally responsible for performance of lubricants.

PAOs have a broader temperature range and are great for use in applications exposed to extreme cold and/or high heat. With their purity and stability they are becoming increasingly more common in lubrication formulations for high quality applications. A general comparison PAO versus Group III mineral oils with respect to their quality features is given in Table-4.

| FIELD1 | API Group III | PAO |

|---|---|---|

| Hydrocarbon Type | ~100% Saturates | 100% Saturates |

| Parafins | 35-80% | 100% |

| Cycloparafns | 20-65% | None |

| Sulfur | 0-300 ppm | None |

| Nitrogen | Small to None | None |

Ester’s and PAO’s are often used in blending stocks to improve the characteristics of Group I through III base oils. Esters offer advantages to base oil mixes such as improved solvency of additives, improved sludge dispersancy, lower friction coefficient, improved bio-degradability, and improved thermal stability.

The synthetic market faces many challenges due to improving quality of Group III+ base oils. Due to tightening specifications for automotive lubricants and increased performance expectations for industrial oils all-hydroprocessed Group II and III base oils will increase in their importance for use in lubricant formulations.

Selected top-tier lubricants requiring PAO will continue to coexist with Group III oils as they have edge over the mineral base oils. But widespread availability of modern Group II and III mineral oils is accelerating the rate of change in lubricant markets. New and improved base oils are helping engine and equipment manufacturers economically meet increasing demands for better, cleaner lubricants. The current market trend of passenger car motor oil (PCMO) is also shifting from base line Group I base stock to higher category of API base stocks.

As base oil technology continues to evolve and improve, consumers will enjoy even greater protection of automobiles, trucks and expensive machinery such as turbines. Lubrication performance that previously was achieved only in small-volume niche applications, using PAO and other specialty stocks, is now widely available using the new generation of Group II and Group III, III+ oils. Certain applications, such as industrial, heavy-duty diesel and marine lubricants still remain with Group I due to high viscosity and solvency.

As base oil technology continues to evolve and improve, consumers will enjoy even greater protection of automobiles, trucks and expensive machinery such as turbines. Lubrication performance that previously was achieved only in small-volume niche applications, using PAO and other specialty stocks, is now widely available using the new generation of Group II and Group III, III+ oils. Certain applications, such as industrial, heavy-duty diesel and marine lubricants still remain with Group I due to high viscosity and solvency.

Base Stock Market and Changing Scenario in Indian Context

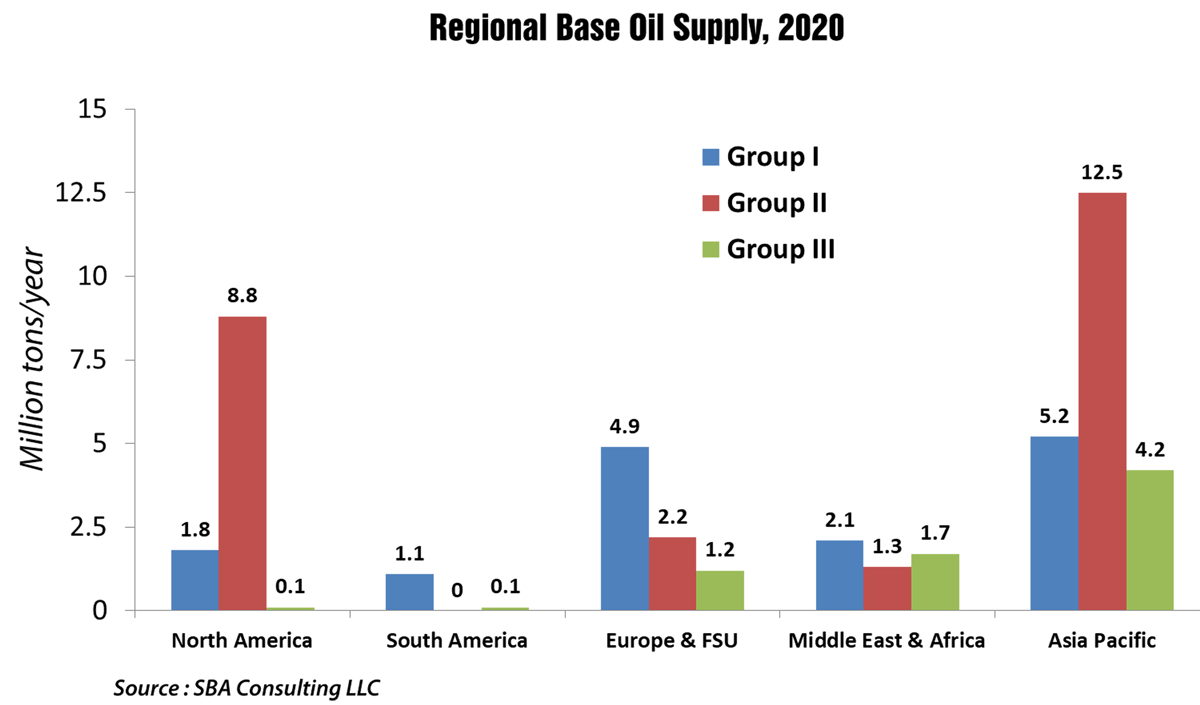

The global finished lubricants market is moving with slow pace and remains just under 40 million tonnes. In addition, market requirements are continuing to shift toward lower viscosities and higher performance to meet the demands of newer engines. These trends are driving capital investment, which is resulting in a global imbalance in supply and demand for both grades and quality levels. Base stock quality level demand varies significantly by region, and even by country within some regions.

The global finished lubricants market is moving with slow pace and remains just under 40 million tonnes. In addition, market requirements are continuing to shift toward lower viscosities and higher performance to meet the demands of newer engines. These trends are driving capital investment, which is resulting in a global imbalance in supply and demand for both grades and quality levels. Base stock quality level demand varies significantly by region, and even by country within some regions.

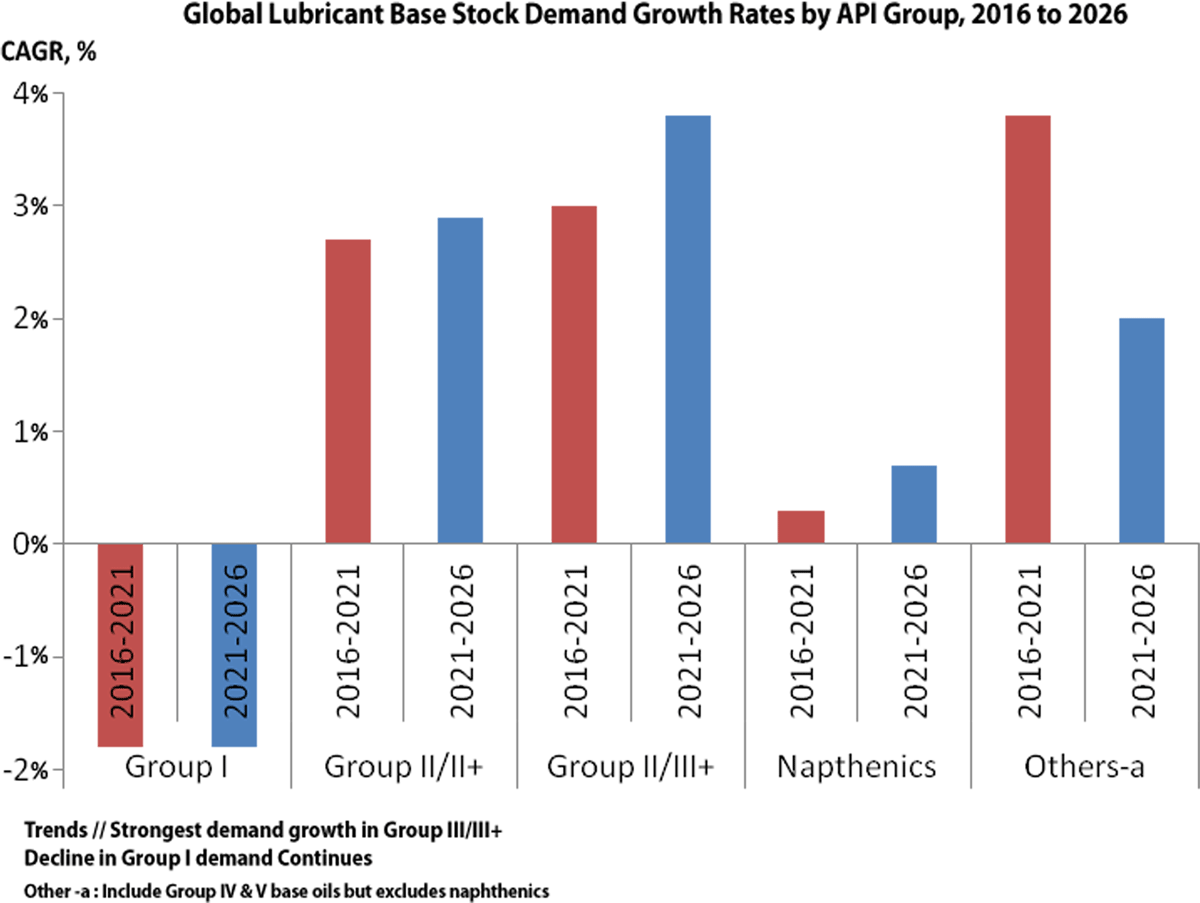

The recent base stock demand trends are expected to continue as lubricants trend to even lower viscosities and improved oxidation stability and deposit control performance. This indicates strongest demand growth in Group III and III+ products.

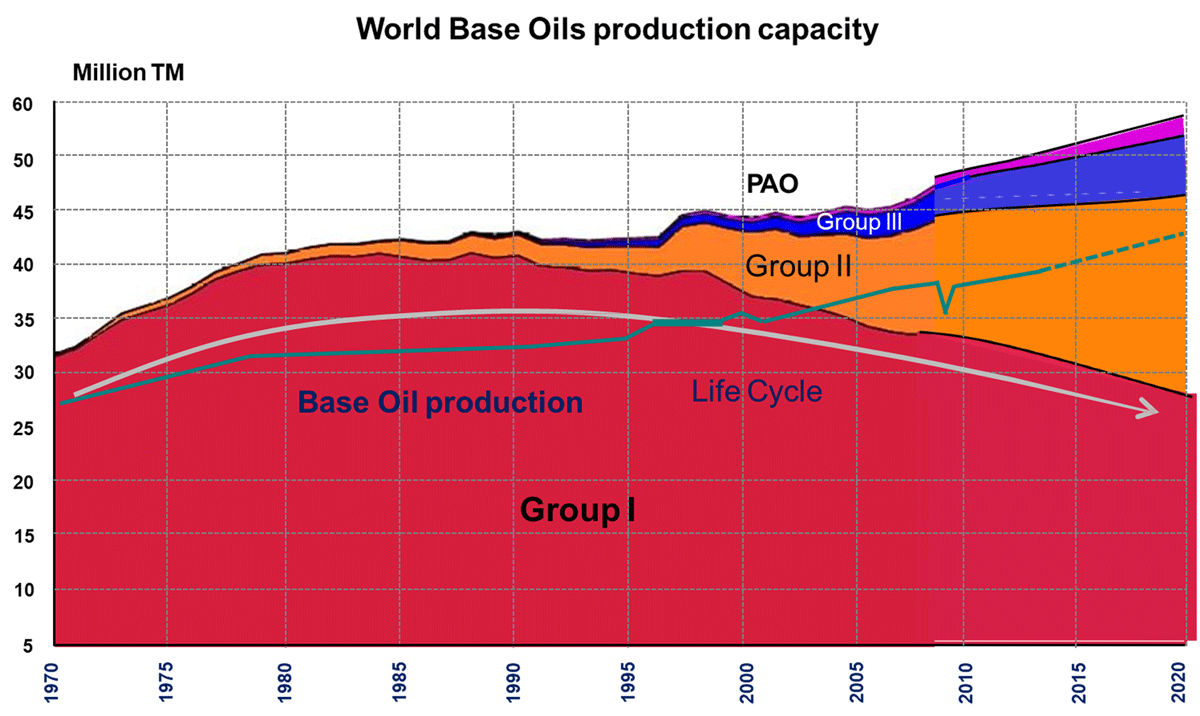

The global base stock market is in a period of relative uncertainty and rapid change. Group I production rationalisations, Group II & III capacity increases, supply and demand imbalances, the introduction of bio-based feed stocks and the explosion in the number of base stocks that may need approvals in lubricant formulations all have a direct impact on lubricant industry.

The global base stock market is in a period of relative uncertainty and rapid change. Group I production rationalisations, Group II & III capacity increases, supply and demand imbalances, the introduction of bio-based feed stocks and the explosion in the number of base stocks that may need approvals in lubricant formulations all have a direct impact on lubricant industry.

By 2020, almost one-half of global lubricant demand will come from Asia Pacific. In contrast, Europe, including Russia, will consume only about one-sixth of total production.

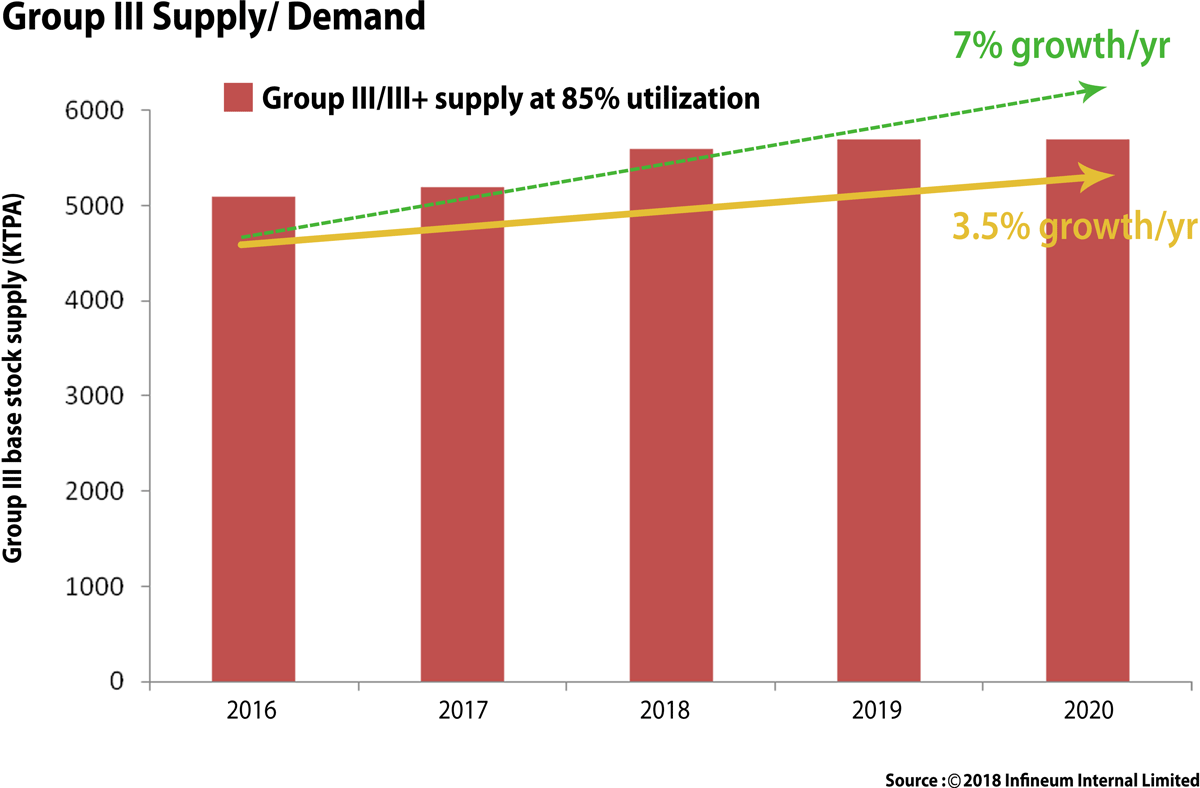

The Group III demand continues to increase due to lighter base stocks required for newer engine designs for the key passenger car motor oil (PCMO) sector. This trend began in 2017 and continues to be a global demand driver for the Group III base stocks as OEMs (Original Equipment Manufacturers) continues to push for lighter PCMO oils. The demand of Group III is expected to grow @ 3.5 % growth/year till 2020 and trend is likely to touch 7 % growth/year by 2025-30.

Group I remains a challenge and the proportion of Group I in global base stock consumption has fallen over the period. The trend that is likely to continue and consumption is going to further decline 30-35 % by 2030.The reformulation trends needed to meet tougher crankcase lubricant specifications have pushed Group I base oils out of most of the newer automotive lubricant formulations.

Group I remains a challenge and the proportion of Group I in global base stock consumption has fallen over the period. The trend that is likely to continue and consumption is going to further decline 30-35 % by 2030.The reformulation trends needed to meet tougher crankcase lubricant specifications have pushed Group I base oils out of most of the newer automotive lubricant formulations.

Global base oils demand is expected to show moderate growth to 2026 but efficiency trends are expected to flatten it longer term. Fig:10

On the supply side, global base oils production is gradually shifting to Group II and III, away from Group I base oils. Group II is expected to become the dominant grade, with Group I decline continuing.